Email is vital for business. Even if you don’t rely on email to communicate inside the office, it’s your primary means of communication with your customers. Order status updates, back-in-stock notifications, shipping updates and more are all most efficiently managed through email.

How to Prepare a T5 Slip

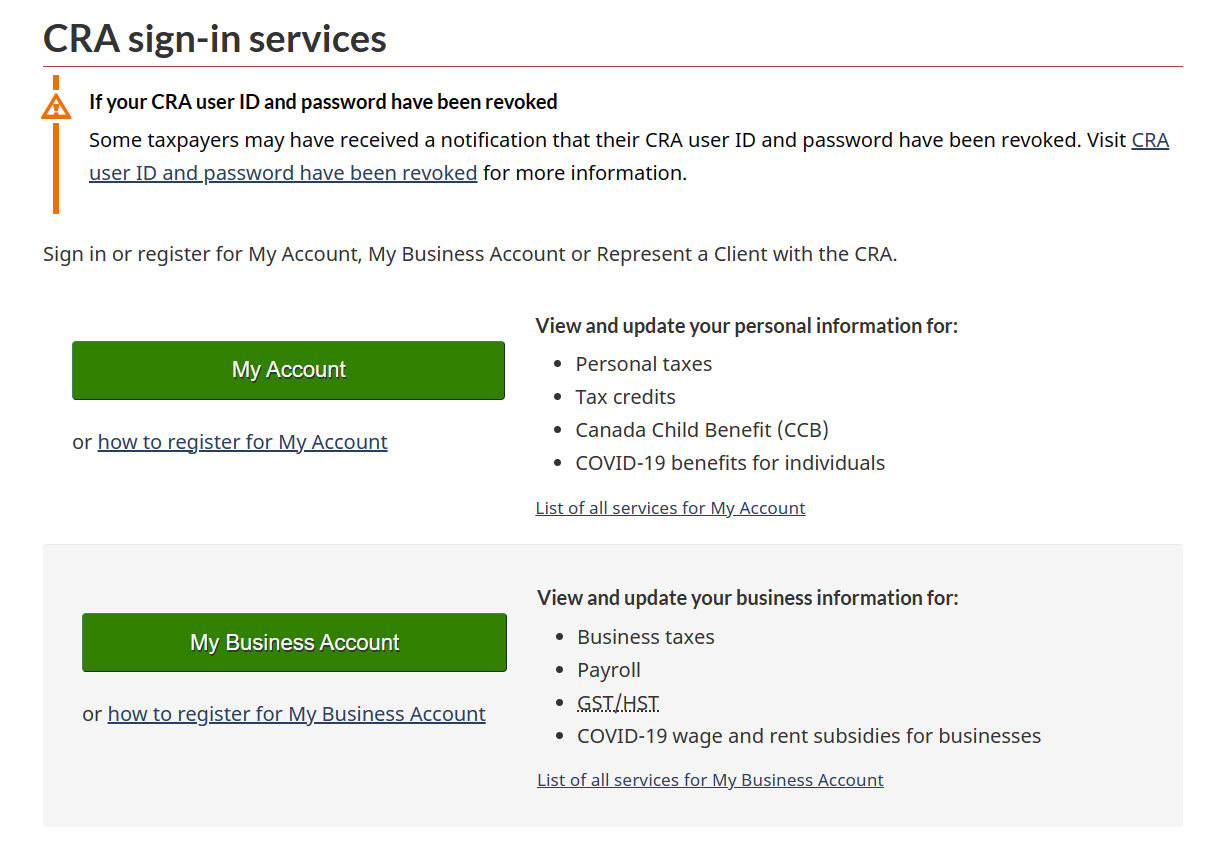

A T5 slip reports dividends paid by a Canadian corporation to its shareholder(s). In order to prepare a T5 slip, you must follow steps below. What is a T5 Slip? A T5 slip reports dividends paid by a Canadian corporation to its shareholder(s). Preparing a T5 Slip In order to prepare a T5 slip, you…