Class tracking enables you to monitor the financial status of your business based on various criteria such as departments, business offices, locations, distinct properties, or any other relevant breakdowns. By employing class tracking, you can effectively keep a vigilant watch over specific segments that are of particular importance to you.

But how to setup the Class Tracking in Quickbooks?

Step 1: Turn on class tracking

- Open your company file.

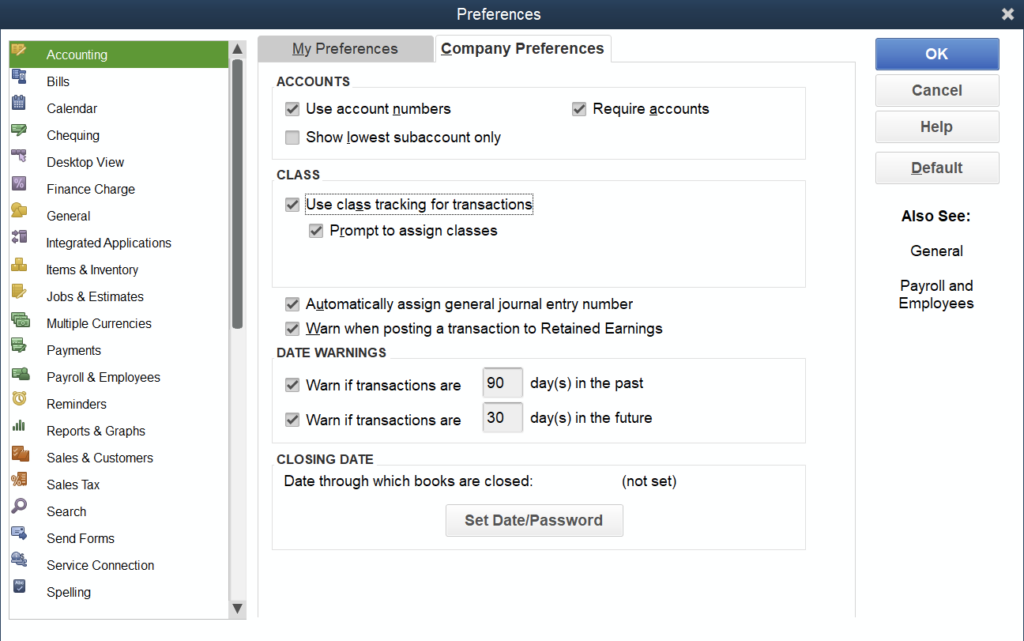

- Go to the Edit menu, then select Preferences.

- Select Accounting, then go to the Company Preferences tab.>

- Select the Use class tracking for transactions checkbox.

- If you want a reminder when you haven’t assigned a class, select the Prompt to assign classes checkbox.

- Select OK.

Step 2: Set up class categories for expenses and accounts

- Go to the Lists menu, then select Class List.

- From the Class ▼ drop-down menu, select New.

- Enter the class name.

- If it’s a subclass, select the Subclass of checkbox and find the class it’s under in.

- Select OKto add it.