Email is vital for business. Even if you don’t rely on email to communicate inside the office, it’s your primary means of communication with your customers. Order status updates, back-in-stock notifications, shipping updates and more are all most efficiently managed through email.

Important Update on Potential CRA Strike

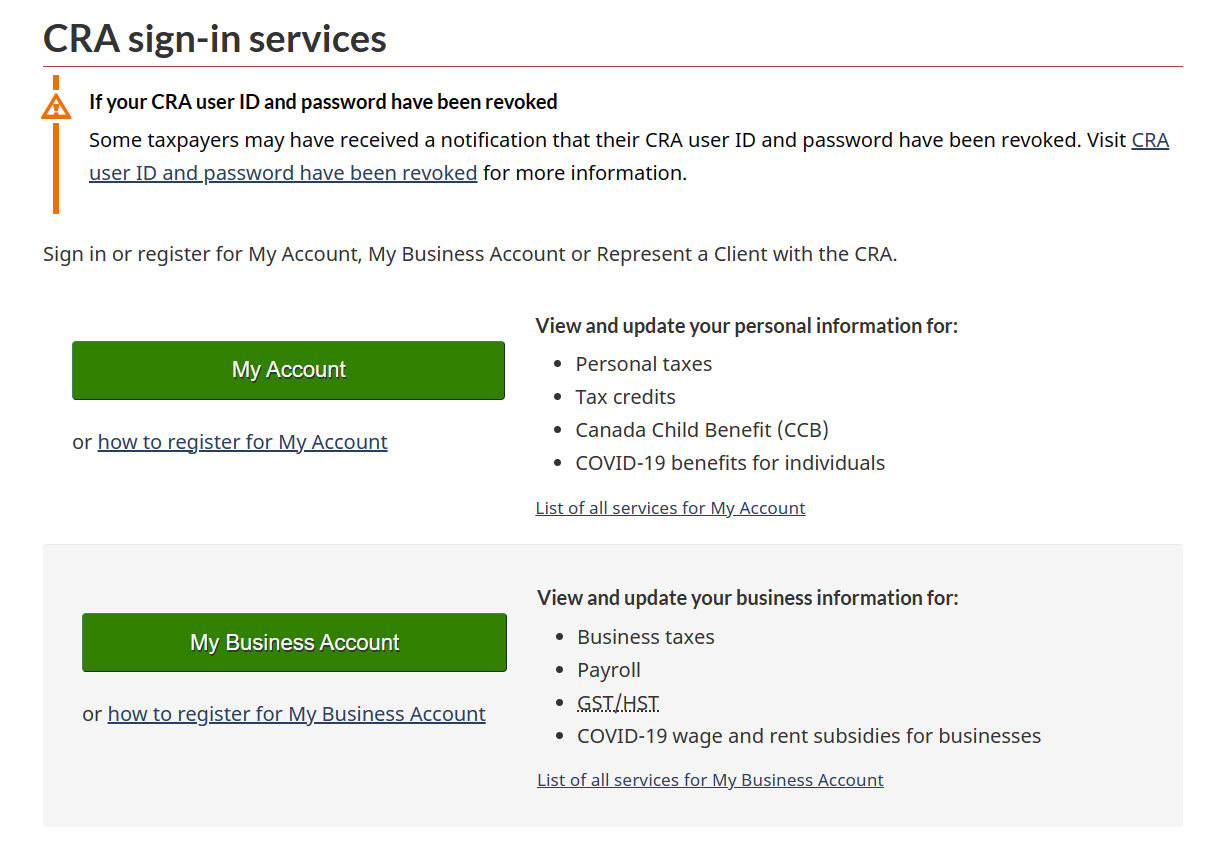

As you may have heard, the CRA employees have voted in favor of a strike. At CPBCanada.org, we will be closely monitoring the situation and will be providing updates on our website. Please be assured that in the event of a strike, CPBCanada.org will continue to be available to provide you with reliable information for filing…