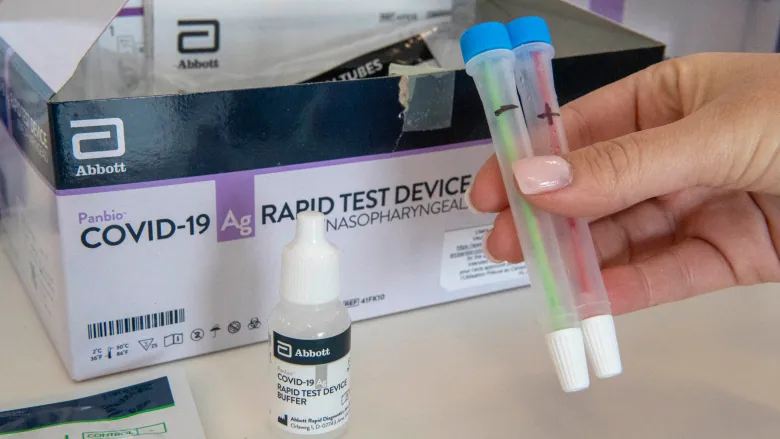

BC Sick Days: What you need to know

On November 24, 2021, the British Columbia government announced that as of January 1, 2022, all employees who fall under the Employment Standards Act will be entitled to 5 employer-paid sick days per year. Which employees are eligible?The paid sick leave provision applies to all employees covered by the Employment Standards Act, including part-time, temporary,…