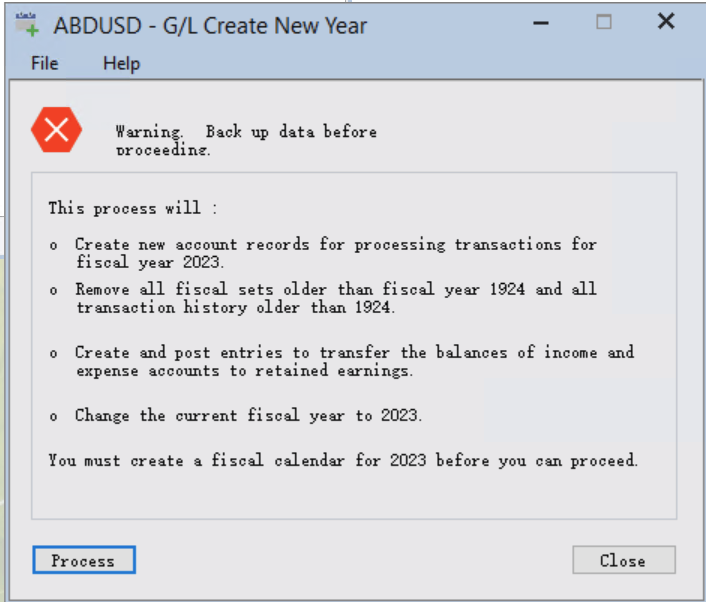

Before you start a new year, please make sure back up your data at begining.

Atfer you back up the data, let us gudie you to next step. First, you will need to create a new year in the fiscal calendar.

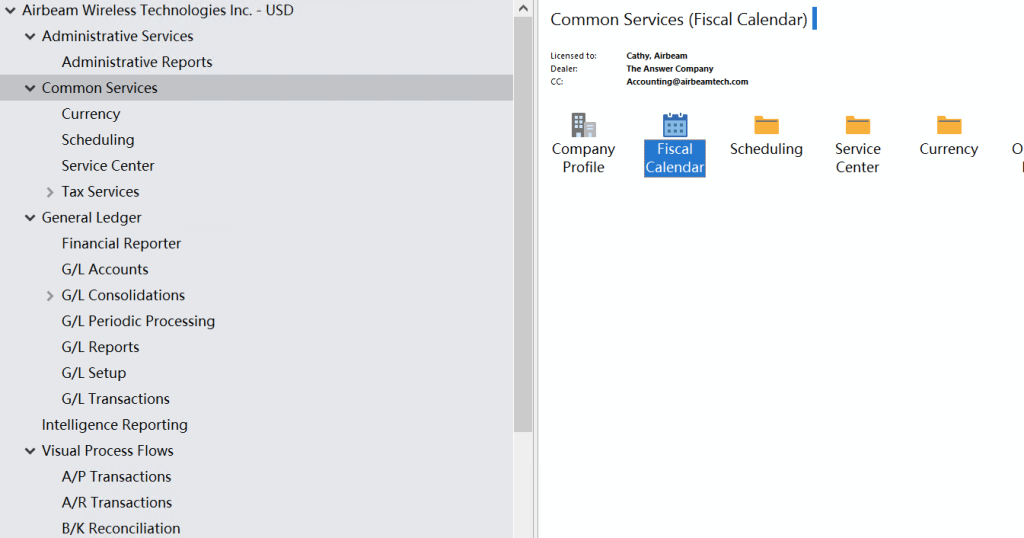

Choose Common Services and then Fiscal Calendar

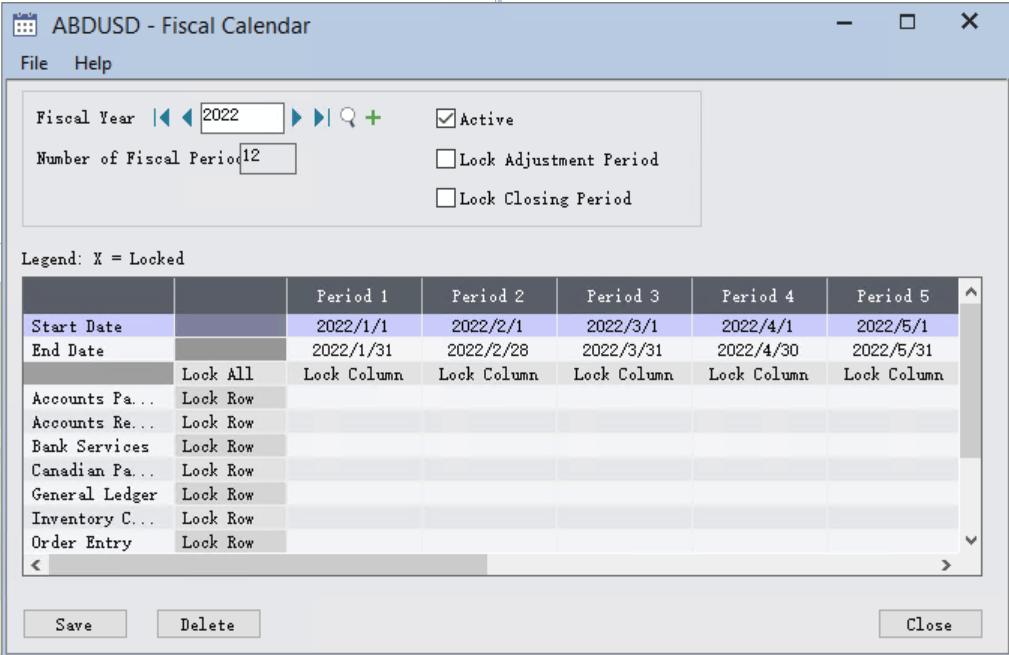

And Then click the croess button. The fiscal calendar screen will let you map out all of the dates for the year.

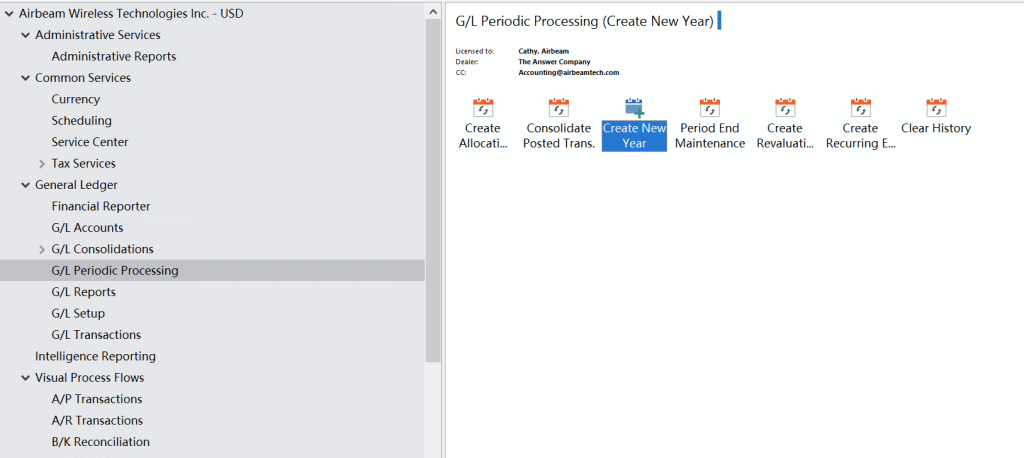

After you define your calendar, you will need to run the Create New Year Process for GL. This process only effects the General Ledger and will create closing entries to retained earnings for all of income and expense accounts.

General Ledger > G/L Period Processing > Create New Year

And then you will see the warning, make sure you read the detials.

Depending on your data size, it may take anywhere from 30 seconds to 30 minutes to process. Typically, it is a few minutes of churning through the data before it completes.

Now, when to run the create new year function is always the hardest decision. You can create the new fiscal calendar at anytime. Once the new year is defined in the fiscal calendar, transactions can be processed in the sub-ledgers. You will not be able to post transactions in the new year in the General Ledger until the Create New Year Process has been run.